massachusetts estate tax return due date

This year April 16 falls on a Saturday meaning that the nearest weekday is on the 15th of the month. Only about one in twelve estate income tax returns are due on April 15.

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Your estate will only attract the 0 tax rate if its valued at 40000 and below.

. This is the due date for the filing and payment of the estate tax return. However confusion sets in when the decedent died after the close of the tax year but before the filing of the prior year income. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax.

The estate tax exemption is 117 million for 2021 and rises to 1206 in 2022. For deaths that occurred on or after January 1 2006 the executor of the estate must file a Massachusetts Estate Tax Return Form M-706 if the gross value of the estate plus adjusted tax gifts exceeds 1000000. Its worth noting that if at least 80 percent of the tax finally determined to be due is not paid.

3 However not every estate needs to file Form 706. Deadlines for Filing the Massachusetts Estate Tax Return. An estate valued at 1 million will pay about 36500.

The federal estate tax has a much higher exemption level than the Massachusetts estate tax. Up to 25 cash back Even if a Massachusetts estate tax return must be filed it doesnt necessarily mean that the estate will owe estate tax. Here you will find a listing of Massachusetts DOR tax due dates and information for filing an extension.

Massachusetts Estate Tax Return. Part 2 line 8. The Massachusetts estate tax for a resident decedent generally is the Credit for State Death Taxes number shown on Line 15 of the July 1999 Form 706 see Form M-706 Part 1.

State Tax Forms. Download or print the 2021 Massachusetts Form M-4768 Massachusetts Estate Tax Extension Application for FREE from the Massachusetts Department of Revenue. When both spouses die only one exemption is applied to the estate.

Supplemental forms such as 706-A 706-GS D-1 706-NA or 706-QDT may also need to be filed. If youre responsible for the estate of someone who died you may need to file an estate tax return. The estate income tax return must be filed by April 15 2022 for a December 31 2021 year end or the 15th day of the fourth month after end of the fiscal year.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. This due date applies only if you have a valid extension of time to file the return. Your estate must file a Massachusetts estate tax return and you may owe Massachusetts estate tax.

The Massachusetts estate tax law MGL. Estimated tax Paid Family and Medical Leave and Health Insurance Responsibility Disclosure are also included. For decedents dying after 2002 the Massachusetts estate tax thresholds varied from year to year as follows.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. Massachusetts is among one of several states that still assesses separate estate taxes on certain property when a person dies. Enter the amount from Part 1 line 7.

US Estate Tax Return Form 706 Rev. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect. The due date for filing the estate tax returns is nine months from the decedents death.

The Massachusetts estate tax is a transfer tax imposed on the value of all property in the estate of a decedent at the date of death and not on the value of property received by each beneficiary. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death. In general if the decedent earned enough income in the final year of life to require filing final income tax returns the final returns for a calendar year taxpayer are due on April 15th following the year of death.

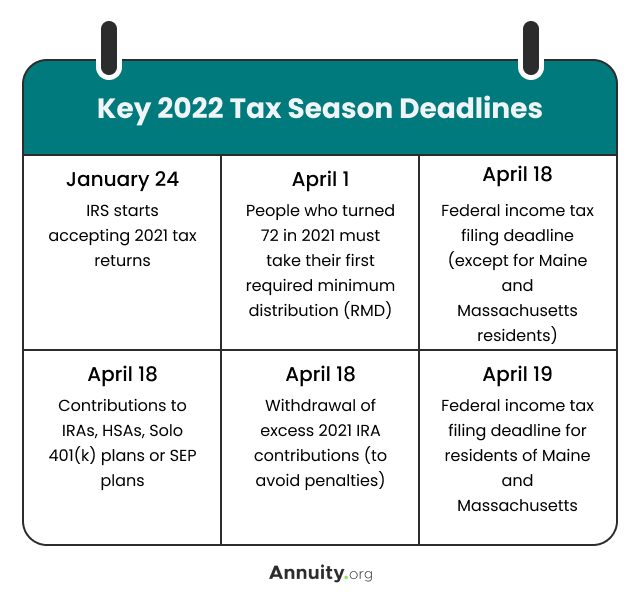

However in Massachusetts residents will actually get an additional day to file their federal and state income tax returns because April 18 is Patriots Day a state holiday. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16. Massachusetts Estate Tax Return Rev.

This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. December 31 2000 see Massachusetts Estate Tax Return Form M-706. The Massachusetts estate tax is not portable between couples.

An estate tax is payable by your estate before estate assets are. It depends on the value of the estate. 1 018 Name of decedent Date of death mmddyyyy Social Security number 3 3 3 Street address at time of death.

The return must be filed and the tax paid within 9 months from. The Massachusetts estate tax is calculated by. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976.

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds 1000000. Massachusetts estate tax due 01 Massachusetts estate tax. The estate tax is a one-time tax due on the value of your taxable estate calculated as of the date of your death.

That is because the attorney or accountant that applied for the ID number may not understand when the tax. Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines Only to be used prior to the due date of the M-706 or on a valid Extension Revised April 2020. As a result the deadline for tax filing is pushed forward to April 18.

2006 through the present 1 million. If a return is required its due nine months after the date of death. Due Date of Massachusetts Estate Tax Return Form M-706 Form M-706 Estate Tax Return is due within nine months after the date of the decedents death.

Please note that the IRS Notice CP 575 B that assigns an employer ID number tax ID number to the estate will probably say that the Form 1041 is due on April 15. If youre responsible for the estate of someone who died you may need to file an estate tax return. Or Part 3 line 5 whichever applies.

The estates first income tax year begins immediately after death. The Massachusetts estate tax return with all required documents and the. Here is the rate.

As of 2016 if the executor pays at least 80 of the estate tax due before the deadline there will be an automatic 6-month extension to file the. These additional forms returns apply to certain. If the due date is a Saturday Sunday or.

The tax year can end on December 31 or the estate can operate on a fiscal year.

Should You Elect The Alternate Valuation Date For Estate Tax

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

The Affluent Investor Financial Advice To Grow And Protect Your Wealth Phil Demuth Financial Advice Financial Literacy Investors

Filing Tax Returns What Executors Need To Know Fifth Third Bank

Estate Tax Exemption 2021 Amount Goes Up Union Bank

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

What Is Inheritance Tax And Who Pays It Credit Karma

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

A Guide To Estate Taxes Mass Gov

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

Basic Tax Reporting For Decedents And Estates The Cpa Journal

How To Avoid Estate Taxes With Trusts

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

2022 Filing Taxes Guide Everything You Need To Know

Massachusetts Estate And Gift Taxes Explained Wealth Management